**How to Budget for Houston Home Taxes Year-Round: 2025 Guide**

*Posted on April 29, 2025 by Houston Smart Finance*

Owning a home in Houston is a dream come true, but property taxes—averaging $6,300 a year for a $350,000 home—can strain your wallet if you’re not prepared. Add mortgage interest, insurance, and potential tax credits, and budgeting becomes crucial. Whether you’re in Cypress or The Heights, this **2025 guide** shares 10 steps to budget for Houston home taxes year-round, helping you save stress and money. Let’s keep your finances as solid as your new home!

—

**1. Estimate Your Annual Property Tax Bill**

Know your Houston tax costs to start budgeting right.

**What to Expect**

Harris County taxes average 1.8% ($6,300 for $350,000), covering city, county, schools, and sometimes MUD fees. Rates vary by area (Katy: 2.2%, Downtown: 1.7%).

– **Action**: Check your bill at [Harris County Tax Office](#) in January 2025.

– **Affiliate Link**: Track with [QuickBooks](#).

– **Related Read**: See [How to Maximize Houston Property Tax Deductions](#).

—

**2. Break Taxes into Monthly Savings**

Spread Houston’s tax burden to avoid a year-end crunch.

**How to Plan**

Divide $6,300 by 12 to save $525/month. Set up a dedicated savings account to cover the Jan. 31, 2026, deadline and dodge 7% penalties ($441).

– **Action**: Open a high-yield savings account by May 2025.

– **Affiliate Link**: Budget with [YNAB](#).

– **Tip**: Automate transfers for discipline.

—

**3. Factor in Mortgage Interest**

Your Houston mortgage affects your tax budget.

**Why It Matters**

Interest (~$19,500/year for a $300,000 loan at 6.5%) is deductible, saving $4,000-$6,000 federally, but you still pay monthly. Budget $1,625/month for interest to plan deductions.

– **Action**: Review Form 1098 projections by December 2025.

– **Affiliate Link**: Monitor loans with [Bankrate](#).

– **Related Read**: Learn more in [How to File Taxes as a New Houston Homeowner](#).

—

**4. Include Homeowners Insurance**

Houston’s insurance costs impact your tax budget.

**What to Know**

Insurance averages $2,400/year ($200/month) in Houston, higher in flood zones ($3,600/year). Budget this alongside taxes to cover escrow payments.

– **Action**: Get quotes by June 2025 for 2026 rates.

– **Affiliate Link**: Compare with [Policygenius](#).

– **Stat**: 80% of Houston homes use escrow for taxes/insurance.

—

**5. Plan for Homestead Exemptions**

Houston’s exemptions lower your tax bill, easing budgets.

**How It Saves**

Exempt $100,000 of your home’s value for school taxes, cutting ~$1,800/year ($150/month) on a $350,000 home. Apply by April 30, 2026, to adjust your budget.

– **Action**: File with HCAD by February 2026.

– **Affiliate Link**: Save with [Mint](#).

– **Related Read**: Explore [Why Hire a Tax Pro for Your Houston Home](#).

—

**6. Budget for Tax Credits**

Houston home upgrades can reduce your tax liability.

**Smart Planning**

Credits like $3,000 for solar panels or $1,200 for AC upgrades (via Form 5695) offset taxes. Budget $500-$1,000 for installs to claim credits by April 2026.

– **Action**: Schedule upgrades by fall 2025.

– **Affiliate Link**: Find pros via [EnergySage](#).

– **Related Read**: See [Houston Tax Credits Every Homeowner Should Know](#).

—

**7. Protest Your Appraisal**

Lower Houston appraisals mean smaller tax budgets.

**How to Save**

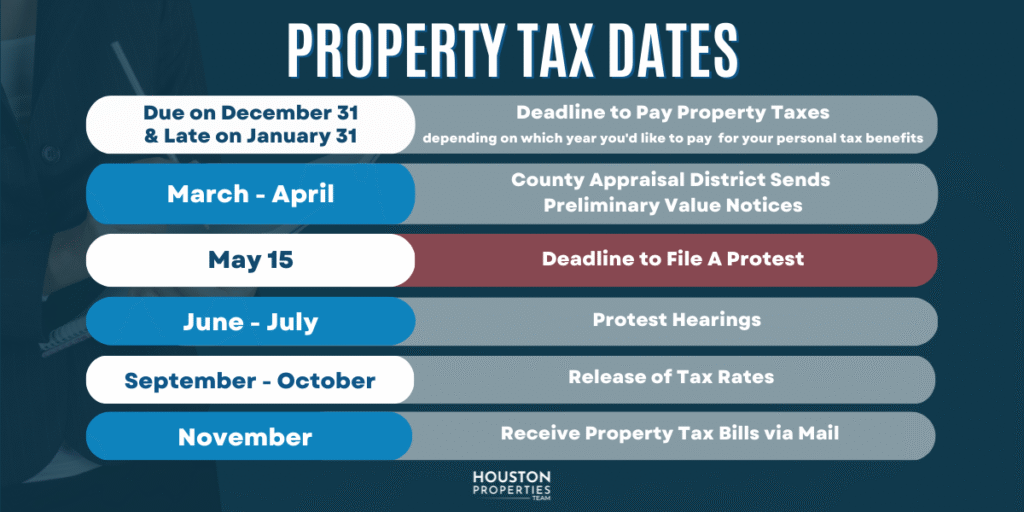

If your $350,000 home is appraised at $400,000, you overpay $900/year ($75/month). Budget time to protest with HCAD by May 15, 2026, using comparables.

– **Action**: Gather sales data by April 2025.

– **Affiliate Link**: Check values with [Zillow](#).

– **Stat**: 40% of Houston protests win $500-$2,000 savings.

—

**8. Account for Escrow Adjustments**

Houston escrow accounts simplify tax budgeting.

**Why Prep**

Escrow covers taxes ($525/month) and insurance ($200/month), but appraisals or rate hikes raise payments. Budget an extra $50-$100/month for surprises.

– **Action**: Review escrow statements by July 2025.

– **Affiliate Link**: Refinance with [LendingTree](#).

– **Related Read**: Learn in [How to Prepare for Houston Tax Season as a Homeowner](#).

—

**9. Save for Tax Pro Fees**

A Houston tax pro saves money but needs budgeting.

**Cost vs. Benefit**

Fees ($100-$400) yield $500-$2,000 in extra savings on deductions/credits. Budget $25-$35/month to hire H&R Block by March 2026.

– **Action**: Set aside funds by December 2025.

– **Affiliate Link**: Book [H&R Block](#).

– **Tip**: Pros catch credits DIYers miss.

—

**10. Monitor Your Credit for Refinancing**

A better rate lowers Houston tax-related costs.

**Long-Term Budgeting**

Refinancing a $300,000 loan from 6.5% to 5.5% saves $200/month, freeing cash for taxes. Budget time to boost your score (700+) by mid-2025.

– **Action**: Check score monthly.

– **Affiliate Link**: Monitor with [Credit Karma](#).

– **Related Read**: See [How to Improve Your Credit Score for a Houston Mortgage](#).

—

**Why Budget Year-Round for Houston Taxes?**

Houston’s 2025 market (10% more homes than 2024) and no state income tax make smart budgeting essential. Saving $5,000-$10,000 yearly through taxes, credits, and refinancing powers your goals, whether it’s a Pearland fixer-upper or a Midtown condo.

– **Bonus Tips**:

– Use apps to track savings progress.

– Review budgets quarterly to stay on track.

—

**Call to Action**

Ready to budget for Houston home taxes like a pro? Subscribe to **Houston Smart Finance** for weekly tips to master your finances. Download our [free Tax Budget Checklist](#) or book a tax pro today!

*Disclaimer: We may earn commissions from links, but our advice is tailored for you.*